Why use LeaseQuery as an Integration?

LeaseQuery integrates with several Cloud ERP systems as it is one of the best-certified lease accounting vendors. For Acumatica, the platform creates a smooth transition between the general ledger and the accounting software.

Below are some more benefits of integration of LeaseQuery to a Cloud ERP system:

- Automate journal entries to the general ledger

- Automate accounts payable processes for leased assets

- Maximize a user’s time spent in their ERP, improving user experience and efficiency

- Eliminate human error by using the integration to post journal entries

- Push lease accounting data into ERP to ease the lease accounting transition and simplify the long-term management of a business’ leased asset portfolio

- Streamline workflow to create time for additional projects

If you think your business could benefit from the LeaseQuery Integration, please contact Polaris Business Solutions; infor@polaris-business.com.

Simplify Complex Accounting with LeaseQuery

LeaseQuery is an industry leading accounting software that is known to simplify the complexities of lease accounting. Thousands of organizations use this software for their lease accounting processes and LeaseQuery has become the number one rated cloud-based, CPA-approved solution. This integration allows users to minimize risk, increase efficiency, and discover critical financial insights across your organization.

See below for some of the major benefits of the LeaseQuery software:

- Faster month-end and year-end close process

- SOC Report and AUP Engagement issued by a Big 4 public accounting firm

- Savings and insights from your lease contracts

- Critical date reminders

- Accurate AP reports

- Central repository with easy document retrieval

- Journal entries available with one click

- Consolidated disclosure and compliance reports

- Audit trail and lease change reporting

- Role-based access

Loan Book Dashboard Overview

Like Acumatica, AcuLoan has its own dashboard that can be configured to best fit your needs. This dashboard is configured and designed the same as any other dashboard in Acumatica using the design feature along the top right-hand side of the screen (you can see this in the screenshot above). The AcuLoan dashboard is called the Loan Book Overview.

In the photo below, users will see what the Loan Book Overview dashboard looks like and what tiles are and graphs are available to configure.

On the Loan Book Overview Dashboard, there are several configurable tiles. These help users to see an overview of their loans and accounts in AcuLoan. In this specific dashboard view you can see several things:

• Total Book Value

• Advanced Payments Disbursed

• Receipts Payments Received

• Different Trends – deal size and capitalized interest

• Actual vs. Budget – Income

• View of Certain Loans

There are several other items that can be included on a dashboard for AcuLoan. These tiles and graphs have many customization options. The colors can be changed as well as the thresholds which prompt the tile to “alert.” Dashboards in the AcuLoan program from Acumatica are a great way to get an overview of what is happening in the system. These dashboards can be configured one time for multiple users to see.

If you think you could use a dashboard like this for your loan data, please contact Polaris Business Solutions; info@polaris-business.com.

Endless Acumatica

Acumatica is so much more than just an ERP. There is so much that goes into it and so much that you can utilize. When we talk about Acumatica, we aren’t just talking about the CRM or any other part of the software, we are talking about Acumatica’s business as a whole. Acumatica really values customers and spends a large amount of time putting in the effort to make sure that each customer gets what they need and how they need it.

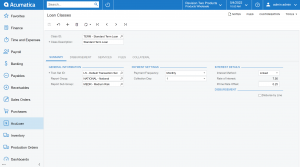

Loan Classes and Reporting Groups | AcuLoan

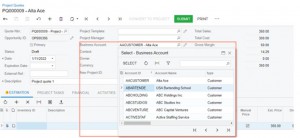

Acumatica 2022 R1 New Feature: Improvements to Project Quoting

In the new release of Acumatica 2022 R1, the system has enhanced the project quoting functionality. The steps to create a project quote have been minimized and users now have the availability to create quotes for multiple related customers. The Projects Quotes (PM304500) screen has been enhanced for a better experience.

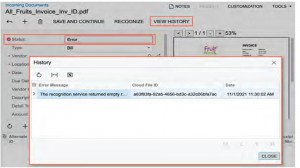

New Feature for Finance Improvements to Recognition of AP Documents

In the latest release of Acumatica 2022 R1, there have been several updates to the recognition of AP documents including resubmitting, searching for a vendor, and mass processing.

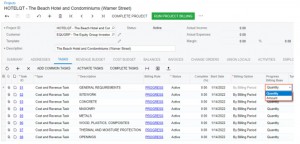

Acumatica 2022 R1 Feature Review: Pro Forma Invoices

Acumatica 2022 R1 has been released and there are several new features to highlight for each edition of the project. To continue with the projects/construction edition, there are a few changes to note about the Pro Forma Invoices Form (PM307000). See the below screenshot and notes with information regarding the changes.

On this form, there are several new columns that have been added. Each of these columns are pulling data in from the Related Revenue Budget Line of the project on the Revenue Budget tab of the Projects Form (PM301000).

· Revised Budget Quantity: revised budget quantity of the line

· Actual Quantity: actual quantity of the line

· Previously Invoiced Quantity: the running total of the Quantity to Invoice column on this tab

· Quantity to Invoice: billing quantity

· UOM: Unit of measure for the project

· Unit Price: Unit price

· Progress Billing Base: Basis of project billing

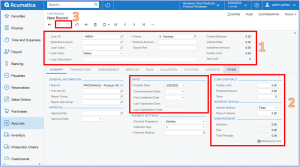

Acumatica 2022 R1 New Feature for Projects and Construction

Changes to the Projects Form

In previous versions of Acumatica, projects billed by progress could only be billed in the revenue that was in the budget lines. With the newest release of Acumatica 2022 R1, billing can now be done in both quantity and amount for the project. These changes are done in the project’s form. In the following sections, we will review these changes.

Creating a loan account in AcuLoan

AcuLoan is a complete loan management and information software program designed to work completely within the Acumatica platform. AcuLoan allows you to house the loan profile in the system while managing the transactions. See below for steps on creating a loan within the system.