Life Cycle of a Loan in AcuLoan

The all-in-one loan management tool built for Acumatica has several components that make it a great fit for many different types of loans for companies in various industries. AcuLoan is built to serve both debtor and creditor types of loans making it a versatile loan management tool seamlessly integrated into Acumatica.

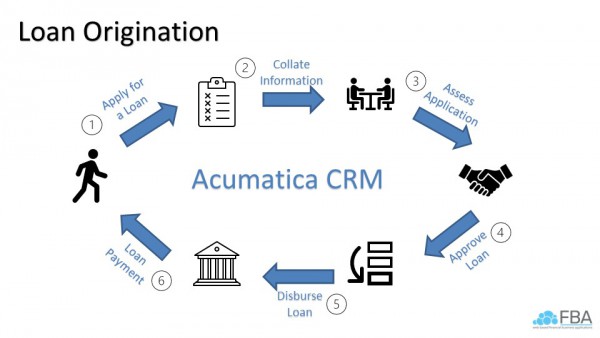

The life cycle of a loan is completely managed within the AcuLoan system. The loan is first entered into the system as a loan account with the “applied for” status. Users then leverage the Acumatica CRM system to assess the application and any documentation associated with the loan. Loans are then approved within the system and users make the payment within AcuLoan. All contact information for the loan account is held in the system for an easy user experience.

The all-in-one tool that Acumatica has for managing loan accounts makes it easy to see all information related to the loan and see how this information ties to accounting details. There is no longer a need for both a loan management program and an accounting program.

If you think your company could benefit from a single system to manage your loan accounts, contact Polaris Business Solutions for a demonstration of AcuLoan. Please email info@polaris-business.com.

Creating a Report in AcuLoan

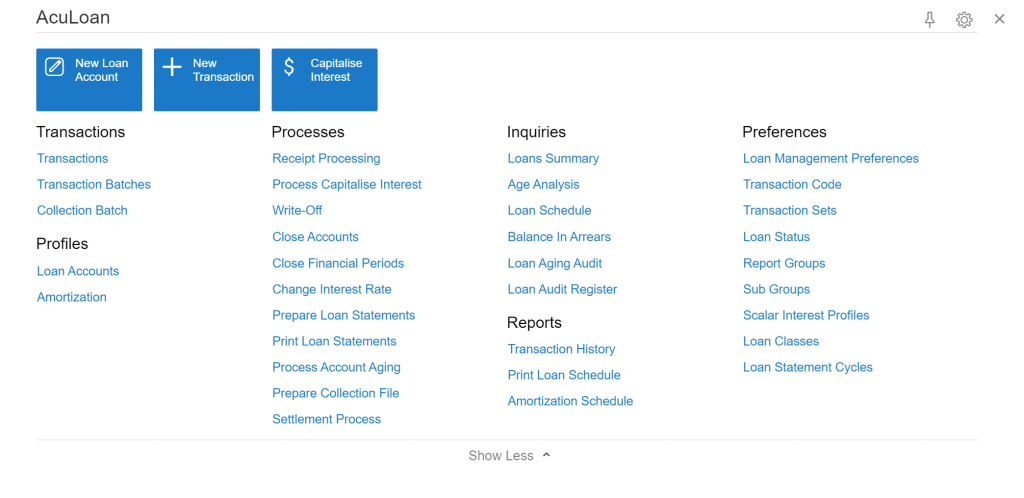

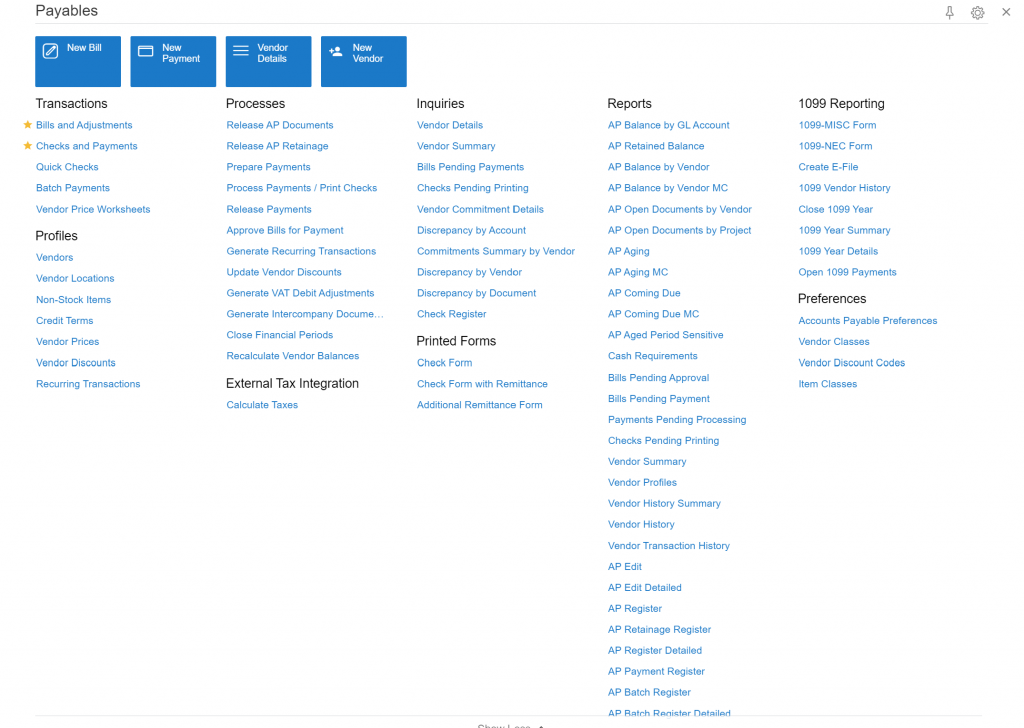

Like Acumatica, AcuLoan has several built-in reporting features that come out of the box. Reporting is essential to the management of loans and many of the reports in AcuLoan show vital information for keeping loans up-to-date, payments processed, and ensuring loans are transacting in the proper way. Some of the reports that are included with AcuLoan are the loan summary, loan schedule, and transaction history report. Above is a full view of the inquiries and reports available in the AcuLoan workspace.

These reports are run in the same way Acumatica reports are run. For example, below you read the steps on how a user can create a report in AcuLoan.

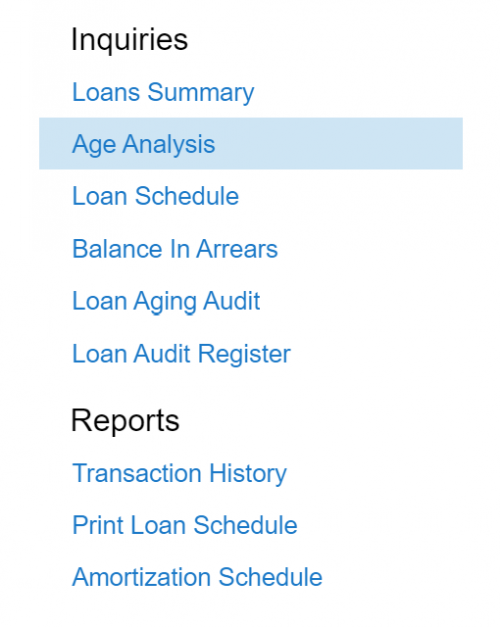

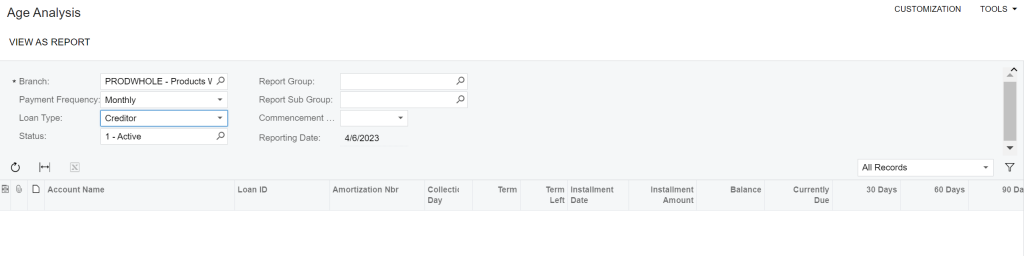

- Users will select the report or inquiry they choose to run. In this example, we will take a look at the Age Analysis Inquiry.

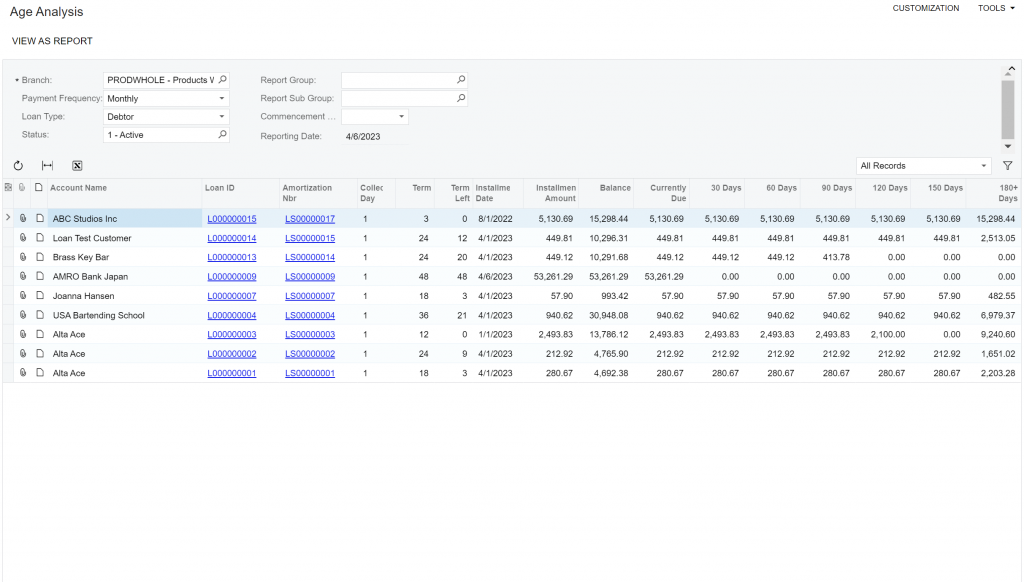

2. Once this loads on the screen, users will select the parameters for running the report.

3. Some of these selections in the header could include branch, loan type, payment frequency, dates, report group or sub group.

4. After selecting the necessary parameters, users will run the report.

4. After selecting the necessary parameters, users will run the report.

5. This will populate on the screen information for users to analyze.

Information in AcuLoan is updated in the same way Acumatica is updated. Real-time data in taken into account when reports are processed throughout the system. Reports and inquiries throughout both Acumatica and AcuLoan can be exported to Excel for further manipulation. Running reports in AcuLoan is a simple, single-system process. Users of AcuLoan access reports from one screen without having to leave Acumatica, this is a great benefit of the AcuLoan integration with Acumatica.

If you think your loan management process could benefit from an integrated reporting process, please reach out to Polaris Business Solutions. We would love to show you a full demo of AcuLoan and all of its great features; aculoan@polaris-business.com.

The Acumatica Framework

Acumatica’s future-proof platform is built on modern and flexible technology that allows it to adapt and evolve with changing business requirements. Some key features that make Acumatica’s platform future-proof include:

2023 R1 – Finance; Additional Updates

With the release of Acumatica 2023 R1, there have been several improvements to different financial management processes, and a few new improvements. See below for an overview of these updates and improvements:

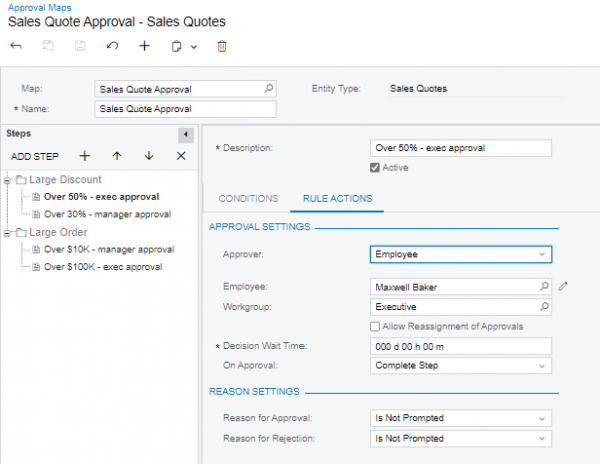

2023 R1 – Delegation and Reassignment of Approvals

Starting with the release of 2023 R1, users of Acumatica have the ability to reassign the request for approvals and have the ability to delegate approvals to other users. This allows companies to run smoothly, even when necessary approvers are out of the office. When original approvers are unable to approve a request, a new approver can be assigned for a temporary amount of time to create an exception to the typical workflow, the existing approval maps do not need to be updated. See below for some examples of how this works.

The AcumatiCares Mission

As businesses become more aware of their impact on the environment, many are looking for ways to operate in a more sustainable manner. One way that businesses can do this is by implementing an ERP system that is designed with sustainability in mind. Acumatica, a cloud-based ERP software, is one such system that is committed to sustainability.

Acumatica Reporting Function:

Acumatica’s reporting functionality is extremely robust and accesses the raw data in the system. It provides users several tools to create, manage, and distribute reports. Reports can be presented in a number of different ways to help management make informed decisions about their company.

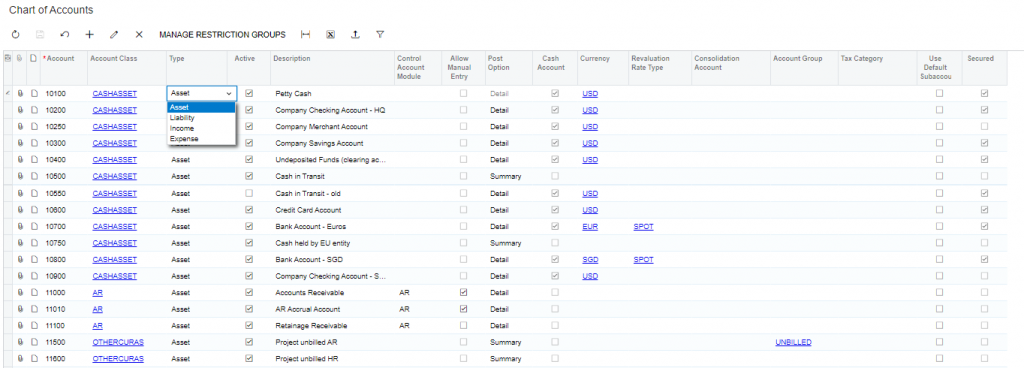

Each Acumatica module has a set of reports built into the system that can be used out of the box. There are over 250 reports standard within Acumatica. Reports are easily modified by end users using Acumatica’s report designer function and users are also able to create templates for reports that are used on a regular basis. Reports in Acumatica can be filtered down and manipulated by account, sub-account, inventory ID, customer ID, and many other filter settings to get information that users need easily.

Acumatica’s Customer Bill of Rights

Acumatica has announced an update to its “Customer Bill of Rights,” which sets forth the basic rights customers should expect from their ERP vendor. The company believes that all customers deserve a level of service and assurance that puts their interests first. The updated bill of rights aims to protect customers from practices that create more problems rather than solve them. Acumatica’s commitment includes offering clear fee structures, fully adaptable and customizable solutions, transparent and fair pricing and agreements, complete security models, accessible data, and more.

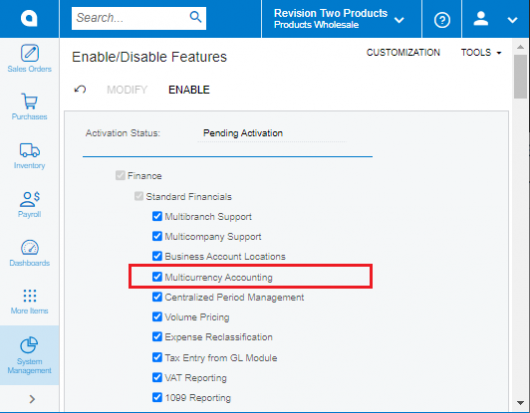

Acumatica Multi-Currency Feature

Does your company deal with multi-currencies? Acumatica has the functionality to stay in control of your finances when dealing with multiple currencies. These advanced features allow users to support international vendors, customers, and others who you may need to manage to run your business. See below a recap of some of the key benefits and main functions of the multi-currency function in Acumatica.

Dynamics SL vs Acumatica; A Discussion about Timecards

This week, our Pre-Sales Consultant, Morgan, and one of our Senior Consultants, Liyi, sat down for a conversation about the major differences between Acumatica and SL and their timecard systems. Overall, Acumatica users have a more seamless user experience when it comes to inputting time and administrators have an easier process when it comes to approving time entry and posting it to the correct project or ledger.

Read below for more information about the conversation: