2023 R1 – Finance; Additional Updates

With the release of Acumatica 2023 R1, there have been several improvements to different financial management processes, and a few new improvements. See below for an overview of these updates and improvements:

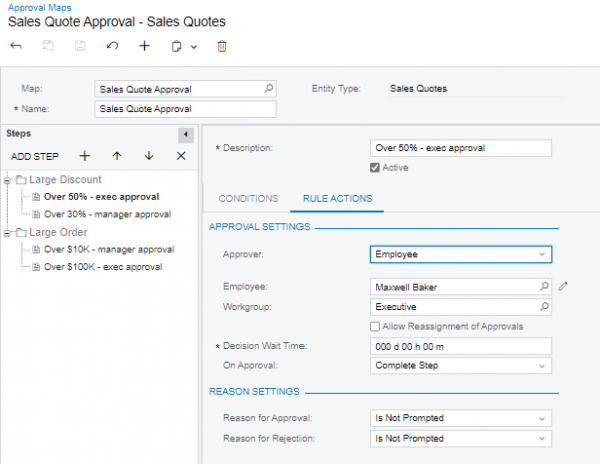

2023 R1 – Delegation and Reassignment of Approvals

Starting with the release of 2023 R1, users of Acumatica have the ability to reassign the request for approvals and have the ability to delegate approvals to other users. This allows companies to run smoothly, even when necessary approvers are out of the office. When original approvers are unable to approve a request, a new approver can be assigned for a temporary amount of time to create an exception to the typical workflow, the existing approval maps do not need to be updated. See below for some examples of how this works.

The AcumatiCares Mission

As businesses become more aware of their impact on the environment, many are looking for ways to operate in a more sustainable manner. One way that businesses can do this is by implementing an ERP system that is designed with sustainability in mind. Acumatica, a cloud-based ERP software, is one such system that is committed to sustainability.

Acumatica Reporting Function:

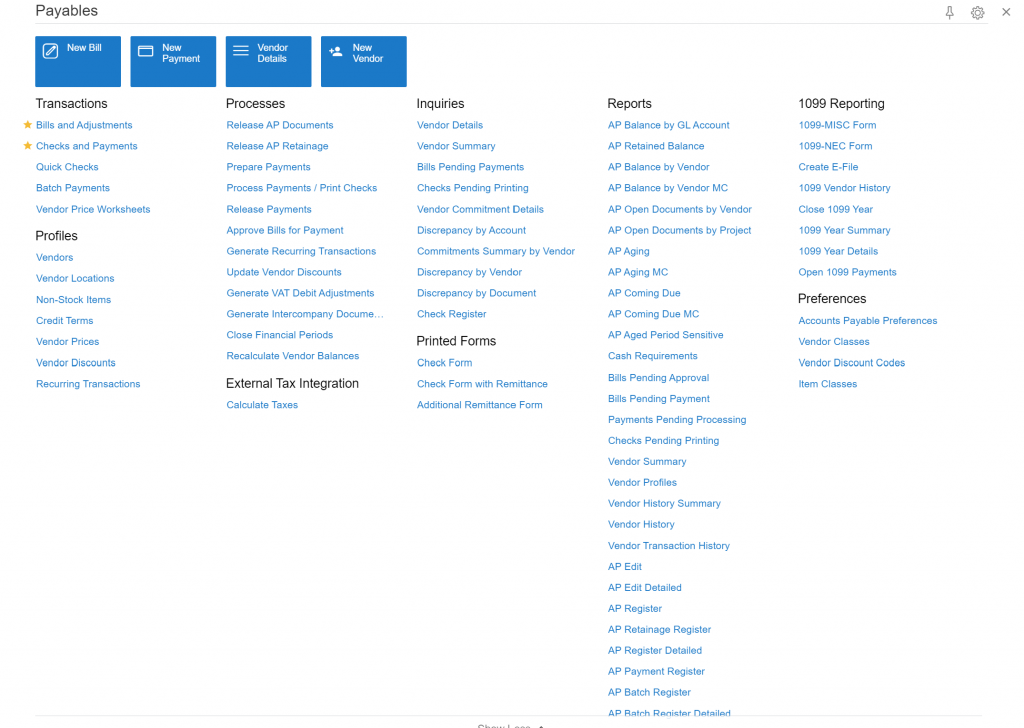

Acumatica’s reporting functionality is extremely robust and accesses the raw data in the system. It provides users several tools to create, manage, and distribute reports. Reports can be presented in a number of different ways to help management make informed decisions about their company.

Each Acumatica module has a set of reports built into the system that can be used out of the box. There are over 250 reports standard within Acumatica. Reports are easily modified by end users using Acumatica’s report designer function and users are also able to create templates for reports that are used on a regular basis. Reports in Acumatica can be filtered down and manipulated by account, sub-account, inventory ID, customer ID, and many other filter settings to get information that users need easily.

Acumatica’s Customer Bill of Rights

Acumatica has announced an update to its “Customer Bill of Rights,” which sets forth the basic rights customers should expect from their ERP vendor. The company believes that all customers deserve a level of service and assurance that puts their interests first. The updated bill of rights aims to protect customers from practices that create more problems rather than solve them. Acumatica’s commitment includes offering clear fee structures, fully adaptable and customizable solutions, transparent and fair pricing and agreements, complete security models, accessible data, and more.

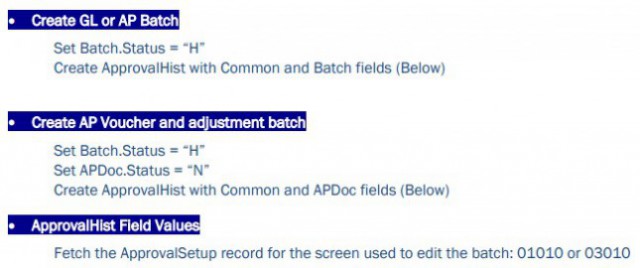

Microsoft Dynamics SL 2018 CU9 Update

CU9 is now out for Dynamics SL 2018. Just like the past few cumulative updates, there isn’t much to go off of but there are a few bug fixes that they have noticed and picked up on. One update that caught our attention is the updates on importing AP and GL transacting. This will help use the approval process.

Another thing with this update is how they are approaching it in terms of the year-end updates that were released in December of 2022. CU9 includes last year’s year-end updates, so if you install CU9 you should be all set and not have to update that.

To learn more about this update or receive more news about updates in the future don’t hesitate to sign up for our Dynamics SL Newsletter.

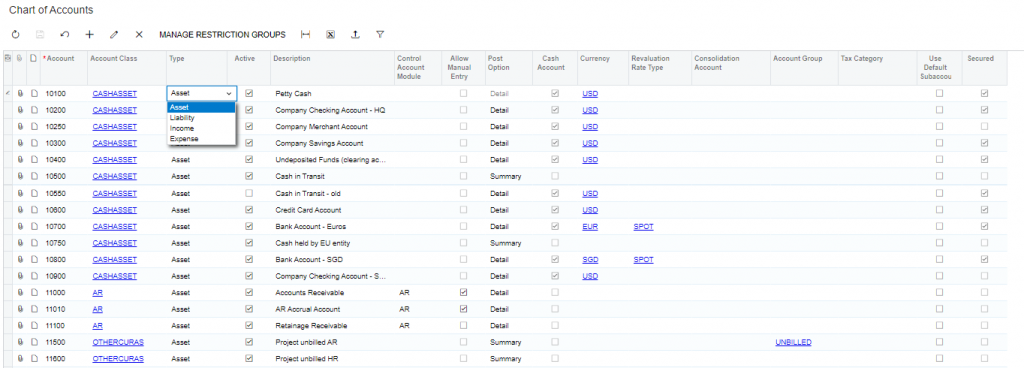

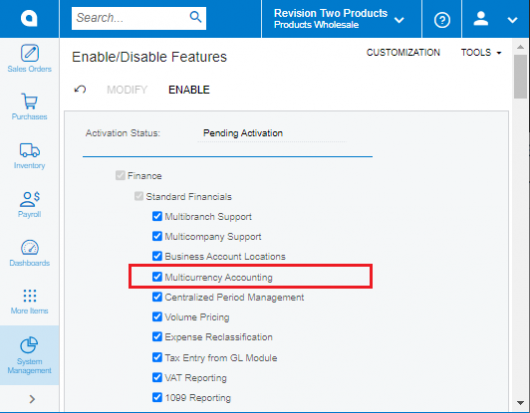

Acumatica Multi-Currency Feature

Does your company deal with multi-currencies? Acumatica has the functionality to stay in control of your finances when dealing with multiple currencies. These advanced features allow users to support international vendors, customers, and others who you may need to manage to run your business. See below a recap of some of the key benefits and main functions of the multi-currency function in Acumatica.

Dynamics SL vs Acumatica; A Discussion about Timecards

This week, our Pre-Sales Consultant, Morgan, and one of our Senior Consultants, Liyi, sat down for a conversation about the major differences between Acumatica and SL and their timecard systems. Overall, Acumatica users have a more seamless user experience when it comes to inputting time and administrators have an easier process when it comes to approving time entry and posting it to the correct project or ledger.

Read below for more information about the conversation:

Acumatica 2023 R1 Preview Updates

After an exciting week at Acumatica Summit 2023, Polaris is ready to take on the New Year! We learned so many new things about Acumatica, met some great people, and enjoyed Las Vegas to its fullest. Acumatica showed us what the company is all about – building the future of Acumatica together.

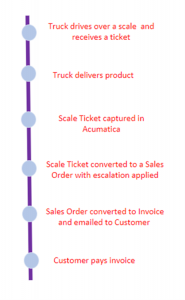

Scale to Cash Cycle

Companies across the asphalt industry have similar ways to complete their scale to cash process. No matter the company, the process depicted in the timeline below must happen for a company to drop off a product, create a sales order, a have a customer create an invoice. Many asphalt companies need a system that can manage estimates, project management, change orders, and many other items related to this industry. Typically, one system cannot handle all these functions and they must be done in several different systems making an integration challenging and difficult for the user.

Categories

Recent Posts

- Modern UI Changes for Acumatica 2025 R1 March 19, 2025

- 2025 R1 Modern UI Updates March 19, 2025

- Simplifying Business with Acumatica’s Intercompany Transactions March 6, 2025