Acumatica vs. Dynamics GP: Navigating the Future of ERP Solutions

In the world of Enterprise Resource Planning (ERP) solutions, businesses often find themselves at a crossroads when deciding which platform best suits their needs. Two names that frequently come up in these discussions are Acumatica and Dynamics GP (formerly known as Great Plains). Both have their strengths and weaknesses, but as time goes on, it becomes increasingly apparent that Dynamics GP may be a dying product. In this blog post, we’ll take a closer look at Acumatica and Dynamics GP, comparing their features and capabilities in today’s rapidly evolving ERP landscape.

2023 R2 Acumatica Payments Function

Acumatica Opportunity to Loan Account Creation

AcuLoan for Acumatica refers to a loan management solution specifically designed to integrate with the Acumatica enterprise resource planning (ERP) system. Acumatica is a cloud-based ERP platform that provides businesses with comprehensive financial, operational, and customer management capabilities.

Aculoan integrates with Acumatica’s CRM systems for a fully integrated accounting and customer relationship management software solution. Acumatica’s CRM has robust capabilities for housing contacts, leads, opportunities and creating marketing campaigns and lists.

Creating a loan account from an opportunity is simple in Acumatica. The opportunity holds information such as business account, contact, and estimated close date for the opportunity. The opportunity can go through various stages and can eventually become a won opportunity. The below photo shows the activity screen of the opportunity which can be created for tasks, calls, emails, or notes. All activities related to the opportunity are stored here in the activity tab. Any user with access to the opportunity would be able to view these related activities.

Acumatica’s Security Features

A cloud ERP solution like Acumatica has many benefits and features that help increase the security of the solution. An ERP system safeguards businesses through effective cloud ERP security capabilities that don’t require expensive investments for buying new hardware or expanding security and IT teams. Extensive security allows companies to have peace of mind against threats of data breaches or attacks. Below are three ways Acumatica’s cloud ERP can help improve your business’s security.

Acumatica 2023 R2 Preview

As we approach the end of the year, a new release of Acumatica is ready. This is always an exciting time as we get to explore new and updated features of the product. 2023 R2 is set to have some great additions and updates to each of its industry editions and the product as a whole. The overall goal of this new release is “intuitive design, seamless execution.” […]

Acumatica’s Framework

Acumatica is a cloud-based enterprise resource planning (ERP) software platform that offers a comprehensive suite of business management applications. Acumatica’s framework refers to the underlying architecture and technology that powers the platform.

Types of Manufacturing Suited for Acumatica

Every manufacturer has a different way of creating its products. Acumatica’s Manufacturing Edition can support many different types of production methods. Below finds a list of the types of production methods that Acumatica supports.

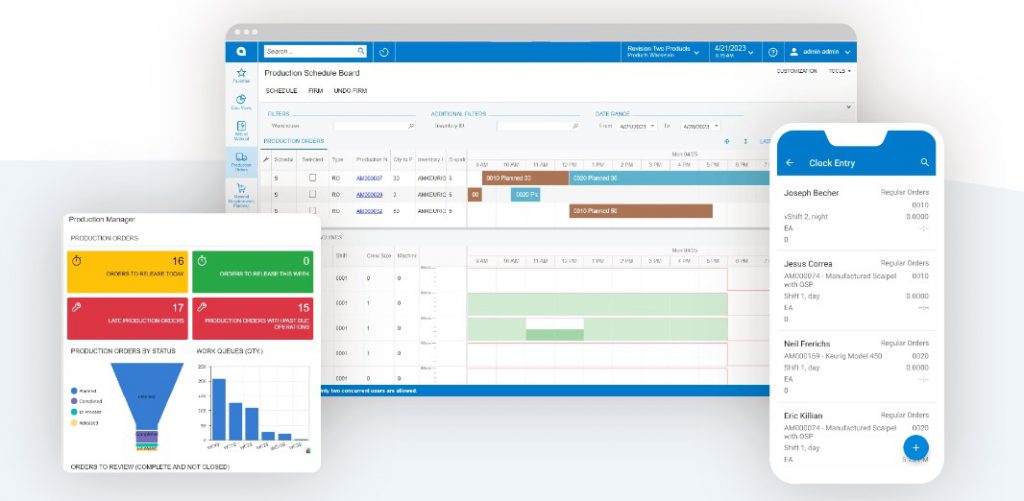

Acumatica’s Manufacturing Module

The manufacturing module within Acumatica is designed to help organizations streamline and optimize their manufacturing processes. Many of the features needed to run a successful manufacturing company are all in one system with Acumatica. Here are some key features and functionalities often associated with Acumatica’s manufacturing module:

- Bill of Materials (BOM) Management: The module allows you to create and manage bills of materials, which are detailed lists of components, subassemblies, and raw materials required to produce a finished product. This helps in understanding the structure of products and their associated costs.

- Work Order Management: Acumatica’s manufacturing module typically includes tools for creating and managing work orders. Work orders define the tasks, processes, and resources required to manufacture a product. This can help in tracking the progress of production and managing resources efficiently.

- Production Scheduling: Manufacturing often involves complex scheduling to ensure that resources (such as equipment and labor) are allocated optimally. The module may include features for visual production scheduling, allowing you to plan and adjust production timelines.

- Material Requirements Planning (MRP): MRP functionality helps in determining the materials needed for production based on factors like demand, lead times, and inventory levels. This can assist in avoiding shortages or overstock situations.

If you are a manufacturing business looking to streamline your business processes, please reach out to Polaris Business Solutions. We would love to show you a demo of Acumatica. Email info@polaris-buisness.com for more information.

Acumatica CRM Module

Acumatica CRM is fully embedded into Acumatica’s financial modules. Here are some key features and functionalities typically associated with Acumatica’s CRM module:

- Contact Management: Acumatica CRM allows you to store and manage detailed information about your contacts, including customers, leads, and prospects. This information can include contact details, communication history, and relevant notes.

- Sales Automation: You can use Acumatica CRM to automate various aspects of the sales process, such as lead assignment, opportunity management, and sales forecasting. It helps streamline your sales efforts and provides visibility into the sales pipeline.

- Marketing Campaigns: The CRM module enables you to plan, execute, and track marketing campaigns. You can segment your customer and prospect lists, send email campaigns, and analyze campaign performance to improve your marketing strategies.

- Customer Support and Service: Acumatica CRM often includes features for managing customer support and service requests. This can involve case management to assist customer service teams in providing timely and effective support.

- Integration: Acumatica’s CRM module is designed to seamlessly integrate with other modules within the Acumatica ERP system, such as financials, inventory management, and order processing. This integration ensures that data is shared across your organization, reducing redundancy and improving efficiency.

- Mobile Access: Many modern CRM solutions, including Acumatica, offer mobile apps or mobile-friendly interfaces, allowing your sales and support teams to access CRM data and perform tasks while on the go.

- Analytics and Reporting: Acumatica CRM typically provides reporting and analytics tools that allow you to track and measure various aspects of your customer interactions, sales performance, and marketing campaigns.

- Customization: Acumatica CRM is often highly customizable, allowing businesses to tailor the system to their specific needs. You can create custom fields, workflows, and forms to match your unique business processes.

- Security: Data security is a critical aspect of CRM systems. Acumatica typically offers security features, role-based access controls, and data encryption to protect sensitive customer information.

- Scalability: Acumatica is designed to scale with your business as it grows, making it suitable for both small and large enterprises.

Is your business interested in a fully integrated customer relationship management system? Please reach out to Polaris Business Solutions for more information; info@polaris-business.com. We would love to show you a full demo of Acumatica and how the modules are fully integrated.

Acumatica is the Complete Solution

Acumatica offers a comprehensive cloud-based Enterprise Resource Planning (ERP) solution designed to help businesses manage various aspects of their operations, including financials, sales, inventory, manufacturing, and more. Acumatica’s complete solution provides a unified platform that integrates different modules to streamline business processes and improve overall efficiency. Here’s an overview of Acumatica’s key modules and capabilities:

- Financial Management: Acumatica’s Financial Management module includes general ledger, accounts payable, accounts receivable, cash management, fixed assets, and intercompany accounting. This module allows businesses to manage their financial transactions, track cash flows, handle vendor and customer interactions, and generate real-time financial reports.

- Customer Relationship Management (CRM): Acumatica’s CRM module helps businesses manage customer interactions, track sales opportunities, and provide exceptional customer service. It includes features such as lead management, contact tracking, opportunity management, and service case tracking.

- Sales Orders: The Sales Orders module enables businesses to efficiently manage the entire sales order process, from order creation to fulfillment and invoicing. It includes capabilities for order creation, pricing and discounts, inventory management, order fulfillment, shipping, and invoicing.

- Inventory Management: Acumatica’s Inventory Management module allows businesses to optimize their inventory levels, track stock movements, manage multiple warehouses, and automate reorder processes. It provides real-time visibility into inventory data to prevent stockouts and overselling.

- Manufacturing Module: Acumatica’s Manufacturing Module assists businesses in planning and executing their manufacturing processes. It includes features for bill of materials (BOM) management, production scheduling, work order tracking, and material requirements planning (MRP).

- Project Accounting: Businesses engaged in project-based work can benefit from Acumatica’s Project Accounting module. It helps track project costs, budgeting, time and expense tracking, resource allocation, and project profitability analysis.

- Reporting and Business Intelligence: Acumatica provides robust reporting and business intelligence tools that allow users to create customized reports, dashboards, and data visualizations to gain insights into various aspects of their business operations.

Acumatica’s cloud-based architecture ensures that users can access the system from anywhere, using various devices. Acumatica’s cloud-based solution enables businesses to choose the specific modules that suit their requirements, allowing for a tailored ERP solution that addresses their unique challenges and objectives. If you think Acumatica is the solution you nee to propel your business in the right direction, make sure to reach out to info@polaris-business.com

Categories

Recent Posts

- Modern UI Changes for Acumatica 2025 R1 March 19, 2025

- 2025 R1 Modern UI Updates March 19, 2025

- Simplifying Business with Acumatica’s Intercompany Transactions March 6, 2025