AcuLoan 2022 R1 Amortization Table Updates

2022 R1 Feature Updates to Amortization Tables

Like Acumatica, AcuLoan has released a new update this year with a new set of features that have upgraded the system. The release of 2022 R1 has made changes to the amortization table. Before the updates to 2022 R1, there were only two ways to calculate using the amortization table. Those were standard and non-standard ways. With the update, see below for examples of how the amortization tables can now to calculated:

Standard; This table will show the interest payment, principal payment, total payment, and remaining payment of the loan balance. This is something that would usually be run each month.

Non-Standard; The table would work best for seasonal companies. An example of this would be a snowplowing company buying a new snowplow in August but not being able to afford to pay until the snowy season in December. The amortization schedule will show how this will amortize without being paid for a few months.

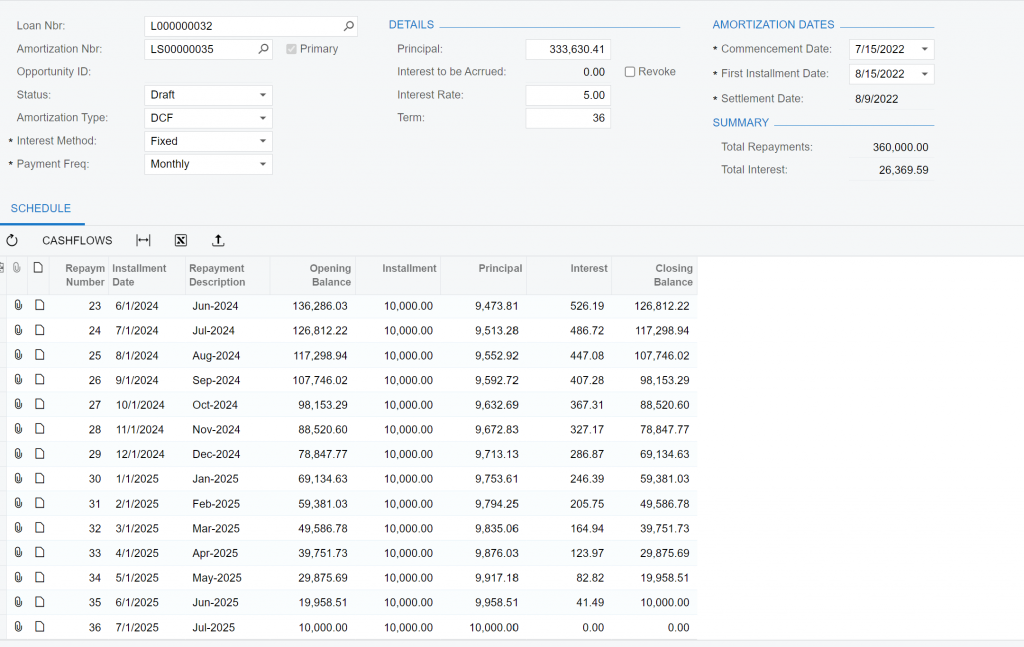

DCF or Discount Cash Flow; This table calculates cash flow based on the time value of money. An example of using this amortization schedule would be in the field of investment finance or real estate. This calculation is run by entering the terms and interest rate for the loan. The AcuLoan system will calculate the principal value.

In the photo above is an example of the DCF amortization calculation. Users are able to select the fields on the left-hand side, the cash flows, and calculate the DCF value.

These updates allow for more users of the AcuLoan system and a wider variety of companies to benefit from the Amortization tables. If you are interested in these updates to the AcuLoan system, please contact Polaris Business Solutions; info@polaris-business.com.