Blog

- Home Uncategorized

- Maximizing Loan Management with AcuLoan and Acumatica CRM Integration

Maximizing Loan Management with AcuLoan and Acumatica CRM Integration

At Polaris Business Solutions, we specialize in delivering tailored ERP solutions to streamline business processes. One powerful combination we recommend is AcuLoan’s loan management capabilities integrated with Acumatica’s CRM module.

This integration bridges the gap between loan management and customer relationship management, ensuring a seamless workflow for businesses managing customer interactions alongside complex loan portfolios. The key benefits of AcuLoan and Acumatica CRM Integration are listed below.

Centralized Client Information

Acumatica CRM keeps all client details in one place. When paired with AcuLoan, loan-specific data, such as outstanding balances and payment histories, are readily accessible alongside customer profiles.

Streamlined Loan Onboarding

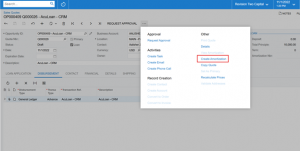

Use Acumatica CRM to track leads and opportunities, then effortlessly convert approved applications into active loans within AcuLoan.

Custom Reporting and Dashboards

Merge CRM insights with loan data to create powerful, customized dashboards. Gain visibility into customer engagement metrics alongside financial performance.

Audit and Compliance Simplified

Maintain a clear audit trail by syncing all loan-related communications and approvals with CRM records, ensuring compliance with regulatory requirements.

Why Choose This Integration?

Combining AcuLoan’s robust loan management with Acumatica’s CRM module delivers a unified platform that enhances efficiency, customer satisfaction, and operational control. Whether it’s tracking loan performance or nurturing long-term client relationships, this integration is a game-changer for businesses seeking scalability and precision.

At Polaris Business Solutions, we work closely with customers to implement this seamless integration and unlock the full potential of their ERP systems. Contact us today at aculoan@polaris-business.com to learn how we can help transform your loan and customer management processes!