2024 R1 – Expense Refunds to Corporate Credit Cards

Expenses at work come up all the time and employees either have to pay for them with a personal credit card or a company issued card, if they are granted access to one. By using a corporate card, employees can easily categorize these expenses and track them in Acumatica. The expenses for a project can be easily tracked and logged right to a project while in the field.

In prior versions to 2024 R1, Acumatica users could not easily process a refund of expenses made with a corporate credit card. The most updated version of Acumatica allows for a negative expense receipt. With this update, an employee can enter the information and processes a negative expense receipt to make a full or partial refund on the corporate card. Another employee can match the receipts and statements records to ensure that everything reconciles.

How to Enter a Negative Expense Receipt

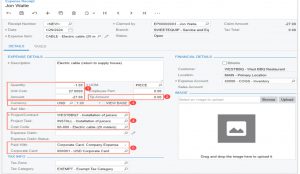

Processing a refund on a corporate credit card is pretty simple! A user creates an expense receipt on the Expense Receipt form and fills in the information on the Details Tab:

1. Amount: A negative amount, the total amount to be returned to the corporate card.

2. Tip Amount: This will be the amount of the non-taxable tips that has been previously included in the amount paid with the corporate card, that was expressed as a negative value

3. Currency: Currency at which the refund should be processed. Note that this can be a foreign currency.

4. Project/Contract, Project Task, and Cost Code: The project, project task, and cost code need to be specified on the expense receipt for the refund.

5. Paid With: Be sure to select the corporate card that the expense was paid with and for which the refund will be processed.

6. Corporate Card: Include the number of the corporate card to refund.

Once the expense receipt is entered, the same process follows with entering a claim. Entering this expense claim for the corporate credit card will show a negative balance on the claim form. Once the user has submitted and released the expense claim, Acumatica will generate necessary GL transactions to debit the corporate credit card and credit the expense account. If related to a project, Acumatica will generate project specific transactions to update the budgets, project, project tasks, and cost codes if needed.

If you are interested in seeing this in action, please reach out to Polaris Business Solutions! We are happy to show you a demo of how this new feature works; info@polaris-business.com

Comments 1

Top Blogs of 2024 | Polaris Business Solutions

[…] 2024 R1 Update to Expense Refunds for Corporate Credit Cards: Read Here 2. 2024 R1 Acumatica Release: Read Here 3. Setting Up Project Accounting: Read Here 4. Aculoan Loan […]